Last Updated: July 26, 2021

Prevedere attended the Path to Purchase Expo (P2PX) in Chicago where the economic implications for the consumer goods industry was at the forefront of the dialogue. Customer behavior is not what it used to be, and that calls for a new direction. P2PX provided an eye-opening experience that gave attendees untapped retail strategies to immediately drive growth. One of the ways to drive growth, as illustrated at the event, is to better leverage data and insights. Prevedere had the opportunity to present to the country’s top brands, agencies, and retailers on how external data factors impact both the US market as a whole and the CPG industry specifically.

State of US Economic, Implications for Consumer Goods Industry

The US economy is growing, albeit at a slower pace. There is increasing uncertainty and indicators show that the manufacturing industry is in peril. There is a bright spot, however, when it comes to consumer sentiment. Consumers buoyed the economy in the last manufacturing slowdown, and their purchasing strength will play a large role in the health of the economy in the future.

What does the current state of the economy mean for CPG? Fortunately, the CPG industry is largely not impacted by the weakest signals in the economy (foreign trade, the housing market, industrial manufacturing, global commodities). Even if some parts of the US economy are hurting, many CPG categories should continue to see growth and/or a continued shift toward premiumization.

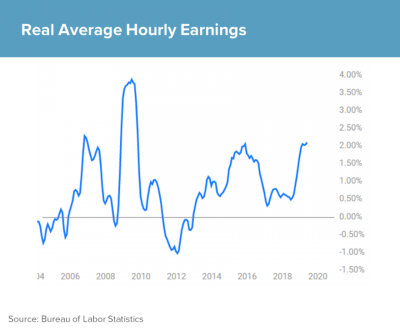

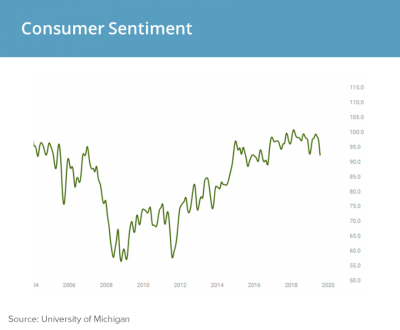

The caveat is that with indications for softening growth, or even mild recession in the second half of 2020, consumers are likely to start changing their behaviors. Companies will need to closely monitor for clues from Sentiment and Wages and other indicators such as Job Openings and Overtime Hours (impactful to future wages) to stay ahead of the game.

Leading US Economic Implications for Consumer Goods Industry

A tight labor market is driving higher wages. This combined with generally low inflation is giving the average consumer an added boost in inflation-adjusted wages and spending power. A leading indicator closely watched by Prevedere and championed by Goldman Sachs retail analyst Joseph Ellis in his book “Ahead of the Curve” is Real Average Hourly Earnings. This is an early business cycle indicator and is at a multi-year high right now, above 2% and rising. This can be anywhere from a 3 to 12-month leading indicator for various food and household consumer good categories.

When it comes to consumer sentiment, the general reading is that consumers are “happy.” Maybe not “as happy” as in 2018, but generally happier than normal, and certainly not as pessimistic as 10 years ago, when the US was fresh in a recession. This indicator is an enabler/ prohibitor. Currently, attitudes are enabling purchasing. If consumers have money in their pockets, they appear content enough to spend it.

10 Trends Reshaping CPG Industry

As part of the session, Prevedere also highlighted key trends reshaping CPG from a report provided in partnership with Coresight Research. Long-established truisms in CPG and retail are gradually being demolished. The beauty industry used to be centered around the female consumer; CPG brands depended on retailers to reach the consumer, and Amazon was a seller of electronics and books rather than an owner of CPG private labels—but these and other longstanding assumptions are changing. As outlined in the report, it is anticipated that CPG will undergo an array of changes, including the rise of male beauty, the use of direct-to-consumer sales channels, the potential disruption of Amazon, and the introduction of lifestyle apparel and accessories brands.

- Trend: CPG brands are tapping into health and wellness

Wellness is the new luxury. CPG companies are expanding into health and wellness products by acquiring wellness companies and cooperating with communities to deliver wellness initiatives. In beauty, consumers are increasingly focusing on products that integrate health and wellness aspects

- Trend: CBD is gaining traction in CPG

There is a huge market opportunity for CBD products. According to Hemp Business Journal, total sales of hemp-derived CBD products are expected to reach $646 million by 2022 from $49 million in 2014—growing at a CAGR of 38%. Consumers are showing interest in the use of CBD for wellness, health and beauty applications as well as for pets

- Trend: Male grooming is gradually evolving to male beauty

One driver of this trend is the growing impact that male beauty influencers have on younger consumers. Male makeup is slowly gaining traction in the US, riding on the growth of the male grooming market. Beauty brands are tapping into the male consumer sector in order to gain a larger market share within their own industry.

- Trend: Premiumization enables CPG brands to remain relevant

With the rising interest in wellbeing, and in a solid macroeconomic context, US shoppers are becoming more willing to spend on premium CPG products. According to a 2018 survey conducted by research firm YouGov, 87% of US consumers do not mind paying extra for quality, and 55% of US consumers tend to choose premium products and services. Consumers prefer to purchase premium CPG products because of perception and the tendency to use such products for special occasions.

- Trend: Lifestyle apparel and accessories brands are extending into the beauty category

This trend is being driven by companies recognizing an opportunity to tap into the beauty market and realizing US consumers’ willingness to spend on wellness. It is estimated that the US lifestyle apparel and accessories market was worth $80 billion in 2018 and the US beauty and personal care market was worth just under $81 billion. There is a multibillion-dollar opportunity for lifestyle brands in the overlap of these two categories.

To access the remaining trends and additional insights, watch “Economic Outlook and 10 Trends for CPG” now >>