Last Updated: April 9, 2020

It is essential to recognize the impact COVID-19 (coronavirus) is having on lives around the world. We want to acknowledge the growing adverse effects the virus is having on human beings—equally important is the immense complexity in combating and stabilizing the spread of this virus.

Our most recent Economic Outlook Report (March 23, 2020), is an examination of the latest economic signals impacted by the global effect felt by COVID-19 (coronavirus). The economic fallout from the COVID-19 health crisis has little in common with historical recessions and offers few comparisons to draw on. So while we like to look to past events to garner a greater understanding of what is happening around us to set expectations, it’s not always possible. As such, we are relying on traditional data, along with what is fundamentally unconventional data, in our efforts to put all the facts into context as this unprecedented event unfolds.

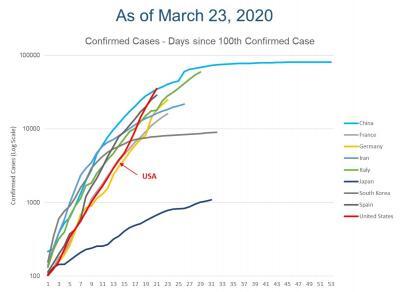

To find a way to put it into context, when we form an outlook for the next few months and into the next year, we are looking to countries that are a bit further along in their coronavirus journey than the United States. This is a highly unusual perspective as an economic practice.

It quickly becomes evident from the graph above that the United States is on a similar trajectory as Europe, with a slight lag. The path is similar to what China has already experienced, as they finally achieve a plateau in new coronavirus cases. And now we look to see how their economy rebounds. Unfortunately, the economic ramifications in China are producing a strong overall contraction. In response, the entire northern hemisphere is bracing for the hit. This immediately calls to question what getting back to normal will look like. And it may be that the new normal is going to look a lot different.

We usually can look at a series of leading vs. lagging indicators where stagnant and declining performance indicates patterns. There is a logical conversation where we can make an evaluation and make reasonable extrapolations of economic and financial ramifications, but the coronavirus environment is more of a statistical anomaly. Any initial hopes of a V-shaped recovery have given way to an extended U-shaped downturn. We are poised for a global recession. Our job is to understand better the context of what a recovery will look like and how long it may take.

The US Economy

In our efforts to better understand the economic landscape, we rely on data. In the US the data is lagging. For example, we usually rely on either monthly reporting for new jobs or even the weekly reports on jobless claims. Suddenly we find ourselves in a world where the normal pace of data releases is not fast enough for us to measure how severe the effects are going to be, so we need to look at alternative data sources. Fortunately, in a world of big data, there are numerous alternative sources of information to utilize. For instance, we have been keeping real-time track of Google search trends surrounding United States unemployment. The numbers are 20-times greater than unemployment-related searches leading up to the last couple of weeks.

We also have anecdotal information from multiple states, New York, California, and Ohio, for example, where their websites have been overloaded because of the number of people seeking to file for unemployment. When studying the official total US Weekly Jobless Claims released on Thursday, March 26th, 2020, the key will be to compare against historical context while considering that the unprecedented unemployment rise is due to the central shutdown of much of the services sector across the country.

With a significant ramp-up in unemployment, businesses are going to be challenged to stay afloat, and we’re going to see some real near-term pain. Of course, there are fiscal and federal responses to this. For one, the Federal Reserve has come up with basically a blank check to try to stimulate the economy through monetary policy using the means that they have available to them. Even bigger is the Coronavirus Economic Rescue Package recently approved by the Senate.

At a time like this, changes in federal policy and fiscal policy are necessary steps to mitigate the blow. This isn’t going to mean that the COVID-19 disaster event will be painless as we move through it. And already we’re talking about estimates of second-quarter GDP being down by double digits versus levels a year ago.

Given that context, I think when we talk to our businesses, we’re really trying to focus on what’s the second half of the year going to look like? How long will this downturn last? Further out, as we start to think about 2021, we realize that there’s going to be multiple new paradigms.

When the Consumer has Changed Drastically

We entered this health crisis with record low unemployment and near record-high consumer sentiment. Consumers, on average, were happier than they had been before, according to most surveys. And unemployment was lower than it had been in decades. And we’d been running about 10 years since the previous recession and overall in a somewhat economically healthy place here in the United States.

But now as we look at the consequences of COVID-19, we hope first and foremost that the health crisis is contained as soon as possible. Even if we do bend our curve of new confirmed cases to reflect more like China, and a little less like Italy, that would be a great thing for humanity, and obviously for the health of the citizens in the United States.

Looking at the business ramifications of this, we need to realize that as the health crisis subsides, the economic crisis is going to linger on a bit longer. There’s going to be debts that need to be repaid. Businesses are going to take a while to recover considering the hit they’re already seeing.

The United States won’t be the only country affected. With the spread of COVID-19 from Asia to Europe to North America, we’re really witnessing a global economic recession. Even if countries in the southern hemisphere, Brazil and Australia, for example, don’t experience devastating illness, they will be faced with especially weak economies over the next couple of quarters as the rest of the world’s economies weaken.

Looking out at the second half of the year, our hope and our best case are that the pandemic will be contained. And as a society, we will start to get back to “normal activity”. However, when it comes to business activity, it is likely still going to be weak. Conditions won’t be as bad as the first half of the year, but things will still be very slow. The actions from federal fiscal policy may be necessary, but they are not going to be a cure-all for the second half of the year.

As we think about the extent of this recession, we should be planning on about four quarters of relatively weak activity with the hopes of leaning more towards the recovery side in the second half of the year. The purpose of this update is to put things in a broader context compared to what we’re seeing today.

Even compared to two weeks ago, the world has changed, and our outlooks have changed. Initially, there was more hope of V-shaped recovery. There was more hope that we could control the pandemic and that the economic consequences of the actions necessary to stay healthy would not be as severe as they are.

What we’re experiencing now is that the reaction to the health crisis is necessarily severe, and necessarily puts the global economy in a contraction. Later, it will be about businesses and individuals persevering to get to the other side and come out of this together. With that said we’re continuing to monitor data on a daily basis.

In the United States, there’s not a lot of near-term economic data from monthly government bureaus because of data lags. That is reflecting just how dire is the situation is. To compensate, we’re looking at alternative sources and diagnosing that the US economy is in a difficult spot, along with Europe and Asia. We, therefore, should expect a global recession with a rather slow recovery in the second half of the year.

Watch the full US Quarterly Outlook Updated with Prevedere Chief Economist, Andrew Duguay

***

About Andrew Duguay – Chief Economist Prevedere, Inc.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.