Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist

Data updated: May 20, 2020

There is optimism and positive news about the slow reopening state-by-state of the US economy. The number of cases has seemingly peaked and sheltering in place is gradually being lifted so that more normal activity can be resumed.

The economist’s role is to probe what ‘normal’ looks like when facing a recession. To help frame how the new normal may look, we can draw at least some conclusions from past recessions. Currently, we know that there’s lots of disruption, significant change and that things won’t necessarily go back to normal, or what we consider the way things used to be. A vital part of the information process relies on understanding the different policies that are in place for opening the economy. We look to these to learn what reopening in the economy might look like.

A Summer of Disappointment for Job Seekers

There are a record number of jobs lost, with more expected through the end of May and into June. The big question is how many of those jobs are going to be regained?

In looking forward to the months ahead, a fair assessment is that job seekers may find a summer of disappointment. Many people have been forced to cancel their vacations and that’s disappointing enough. But the true distress is going to stem from the fact that many who have filed for unemployment are expecting that their job loss is temporary. In fact, a recent Post-Ipsos poll showed that approximately 77% of employees who lost their jobs expect to get them back.

However, traditionally out of economic contractions and recoveries, what occurs is that about four out of every ten jobs lost during a recession are permanent losses. Only around 58% of employees who lost their jobs get their jobs back. There’s a large gap between expectations of things getting back to normal and what the reality will look like.

Applying these figures to the current situation indicates that about 20%, or one in every five, of who lost their job during this coronavirus crisis will be surprised not to regain their position. Combine these two facts regarding expectations about returning to a job and the recent study from the University of Chicago showing 42% of job losses being permanent, highlights a large gap between expectations and what reality will likely be.

Job Displacement

It boils down to a profusion of employment displacement. The number of people who are going to be shocked at not getting their job back will likely be between five and six million people. That number will most likely grow because we are still seeing about two million new jobless claims every single week. That’s a significant tally.

For many Unemployed who are collecting an unemployment check— their benefits check is higher than what they were previously earning— things are generally okay for them at the moment. They have some level of optimism that they can wait out until their job will come back for a return to normal.

However, the real challenge is going to be for those that won’t have a job to return to in a timely matter. What kind of skill sets do they have? What kind of jobs are available in this new economy? Are they able to transfer their skills from their specific sector to a new sector, maybe even a new geography? It’s very difficult and expensive to pick up and move. People who lost their jobs are going to be facing several challenges this summer and into the fall as we try to get back to work. To put this into some context, I’ll use a visual from CNBC:

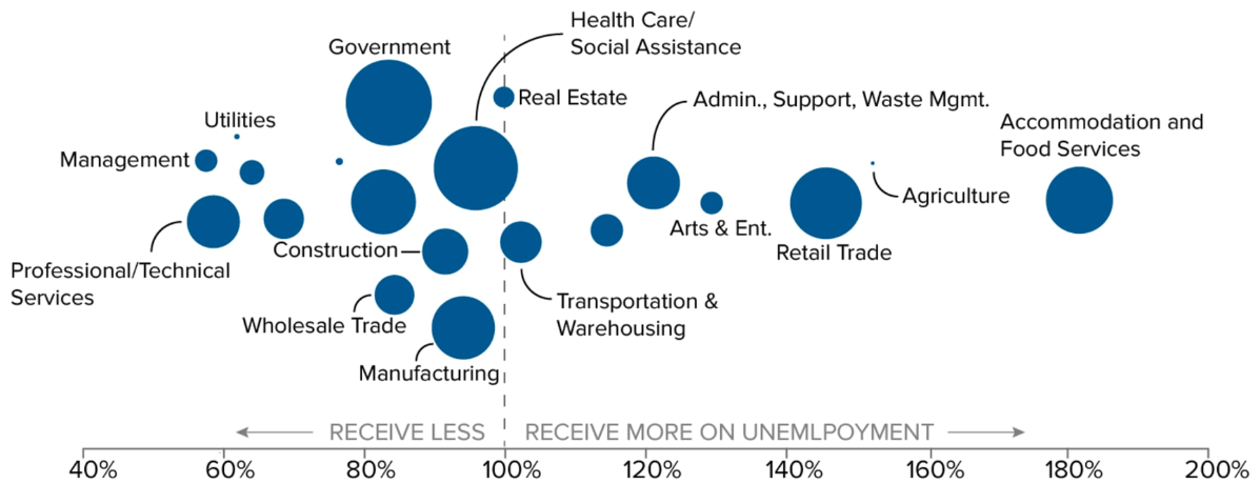

Size of circle represents total employment, Sources: visual by CNBC, data from Bureau of Labor Statistics and US Labor Department

The X-axis along the bottom shows those on the right-hand side receive more on unemployment on average than they were receiving before they started to work. It includes the retail sector, hospitality, and food services. We have already lost aover10 million jobs among these industries in the U.S. through the pandemic shutdown. Employees got laid off and now with state unemployment plus the $600 from federal unemployment, they are typically earning more on average than when they were previously working at their jobs.

It becomes easy to see that the reality might not have set in. It’s a terrible thing to lose your job, but I think the federal government has stepped up and said, we’re not going to punish you for the coronavirus effects. After all, workers were instructed virtually overnight to go home for the health. This is unprecedented. However, the big challenge looms.

The jobs represented in the two larger circles on the right-hand side are where we are expecting considerable displacement in the new economy; many of these jobs are not social-distance friendly occupations. There’s going to be major disruption, with a lot of these jobs perhaps not coming back at all. As evidence, we’ve already seen several bankruptcies of retailers and job losses that were deemed temporary already turning into permanent job losses in the entertainment and hospitality industry. And these headlines keep coming.

Right now, unemployment benefits extend through the end of July. For many, this sets up a very interesting period over the next few months. As businesses begin to open again with easing restrictions, these businesses are going to be forced to assess demand. They are expected to slowly hire back employees accordingly, but initially hiring will not equate to the amount that they laid off. Many Americans are going to be in a state of limbo throughout the summer and into the fall.

If federal unemployment benefits aren’t extended to include the extra $600 a week, there’s going to be a point where all those who remain unemployed will have their unemployment benefits expire in sectors that are on the right-hand side of the graph. That is a problematic position for many Americans.

There are different stages of stress, and we’re just approaching the first stage as businesses begin to open and rehire the first wave of employees back. Limited capacity across most states is going to continue for a couple of months with July most likely being the grand finale. At that time, we will likely see a copious number of people still unemployed, with the possibility of severely reduced benefits post-July.

The Great Job Reallocation

We need to think about the second half of the year. And really, the next three, four, five years because recessions disrupt job markets. This doesn’t mean that all jobs lost will not be recovered. It also doesn’t mean that new jobs won’t be created. However, there will be dislocation and job relocation, leading to what we are calling ‘the great job reallocation’. The period of our economic times in the second half of the year is where we will see new types of jobs available in the market.

The University of Chicago study that found 42% of job losses during a recession to be permanent also studied job creation. Applying this to our coronavirus period, three new jobs will be created for every ten jobs lost. We can look to the different businesses and different industries to demonstrate this. For example, the Amazons of the world are hiring new warehouse workers for every hotel worker that was laid off due to COVID-19. This adds up to 10 million new jobs compared to 30 million-plus job losses since the beginning of March.

This all requires hiring, training and, reallocation, which takes time, energy, and even good government policy to encourage workers to come off of unemployment and accept a new job that’s possibly in a new location. All of this does take time, and this is one of the reasons why we’re saying that even if the health crisis disappears tomorrow, the economic crisis is going to last for a few years. There’s going to be a trough and there’s going to be a period for new jobs to be created, and filled, and businesses to retool for the new economy, and gain perspective.

We’re already looking at total job losses much higher than the last recession, but given the last recession was the worst since the Great Depression, we can use that as a reference. In the last recession, it took around six or seven years to recover all the lost jobs that started in 2007 and 2008. When you think about this recovery, there might be aspects that turn around faster. The last recession had a financial crisis component and credit markets were tightened for a long time. We entered the COVID-19 pandemic economic crisis with a stable and growing economy. What we are looking at currently in terms of economic recovery is multiple years for the jobs that were lost to be recovered.

Part of that is the fact that hiring, training, and reallocation takes time and energy to adapt skills that aren’t necessarily instantly transferable. When we look at the sectors that are most vulnerable —retail, accommodation, food services — a lot of these require lower education and some of the new jobs might require skilled trades in different areas. Since new jobs might require different levels of education than the jobs that were lost, it will take more time to fill those positions.

Conclusion

In summary, what we are looking at is a summer where we are very happy and excited about states opening their economies back up. However, when we think about all the disruption that’s happened over the past eight weeks, there are a lot of jobs that are lost for good. This is going to slowly play out over the summer developing a balance between unemployment benefits and businesses being able to hire the workers they need.

Additionally, this new economy will have to fill millions of new jobs that were not there before. The question will be whether somebody who has been laid off is going to be able to navigate through the coming months and be able to get a new job before their unemployment benefits run out is.

What we are seeing right now is that there is a gap between people’s expectations about the economic rebound and what the reality is going to be with the jobs available as the summer progresses. We’ve certainly reached a vital milestone, but now it will take time to see how it unfolds.

***

A glance at recessions past

2008 Vs 2020

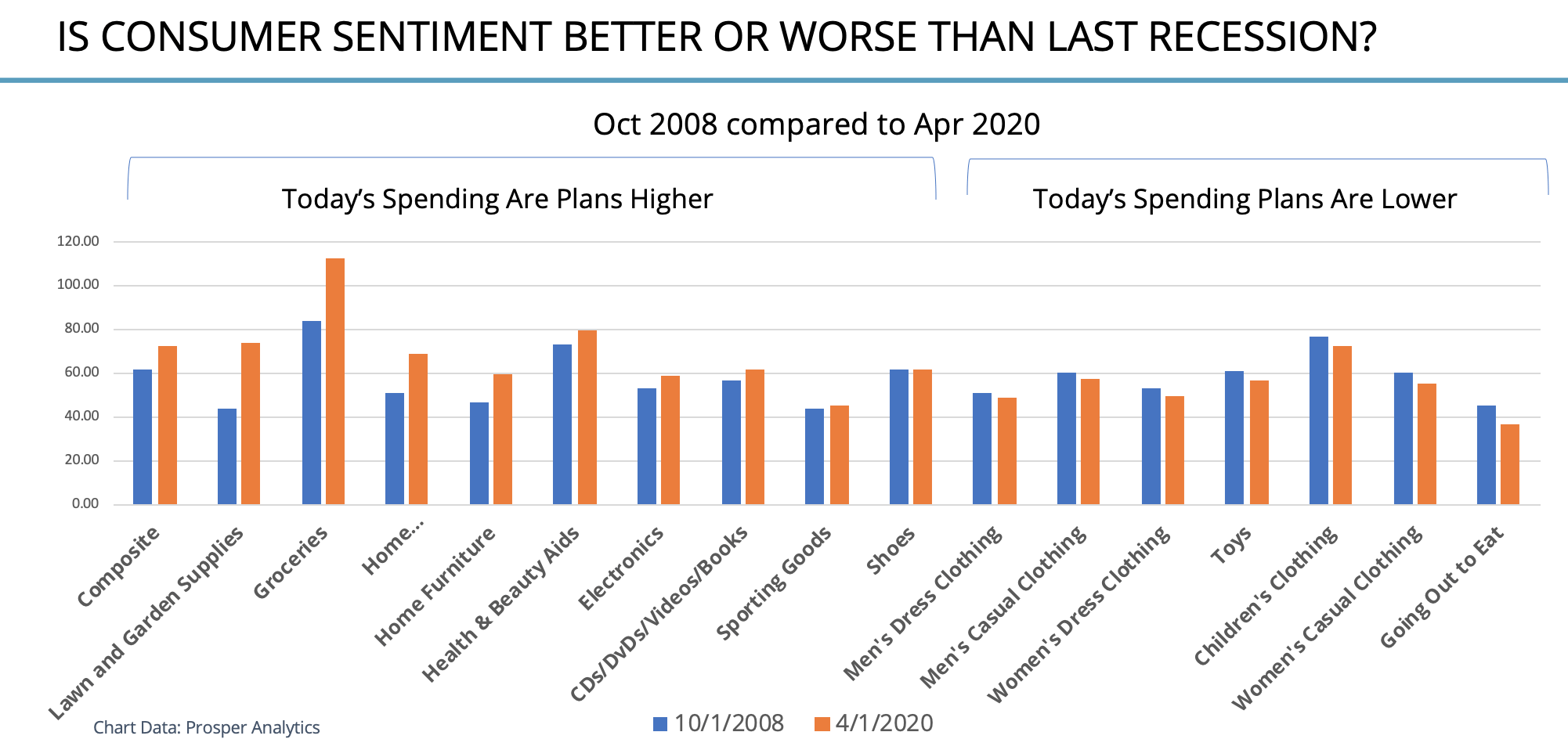

It might not make sense to open up the ledgers and look all the way back to 1980 or even 1990 for comparable information. But we can compare to a recent crisis situation, October 2008, when the stock market went down by 20% and consumer sentiment fell. Here we mapped different consumer spending intent metrics as measured in April versus what they were back in October 2008.

What you can see is that there are some categories of spending where consumers are spending about the same as they were back during the Great Recession of 2008-2009. There’s a lot of areas where today’s spending plans are still higher. For example, when you think about groceries, home improvement, and lawn and garden supplies.

People are out there spending money at hardware stores and thinking about home improvement projects. And they’re still generally thinking about spending more money than they were back during the great recession. And it’s more than just home improvement, there are categories from sporting goods to electronics and even furniture.

Consumer sentiment isn’t quite as low today in those categories as it was in 2008. However, there are areas where consumers are already thinking of cutting back and cutting back more than they were during 2008. And that would be in some areas of clothing, toys, obviously, going out to eat, and a lot in the apparel areas as well.