Last Updated: February 10, 2021

This report, What’s Next for Today’s Consumer?, is the second in a series presented by Prevedere and Nielsen on the changing consumer as a result of COVID-19. Insights are provided by Andrew Duguay, Prevedere Chief Economist, and special guest Nicole Collida, Nielsen SVP & U.S. Brand Effectiveness Lead.

Over the last few months, pandemic-related disruption has created different patterns in consumer spending. As the U.S. begins to emerge from the health crisis, it’s important to get a firm understanding of how the consumer psyche is shaping economic recovery. In a consumer-driven economy through a health crisis, it’s not just a matter of business reopening, but also if consumers feel safe enough to visit open retailers and restaurants. That will likely continue to be the theme for summer and fall—balancing health and safety with the need to get the economic engine rolling again.

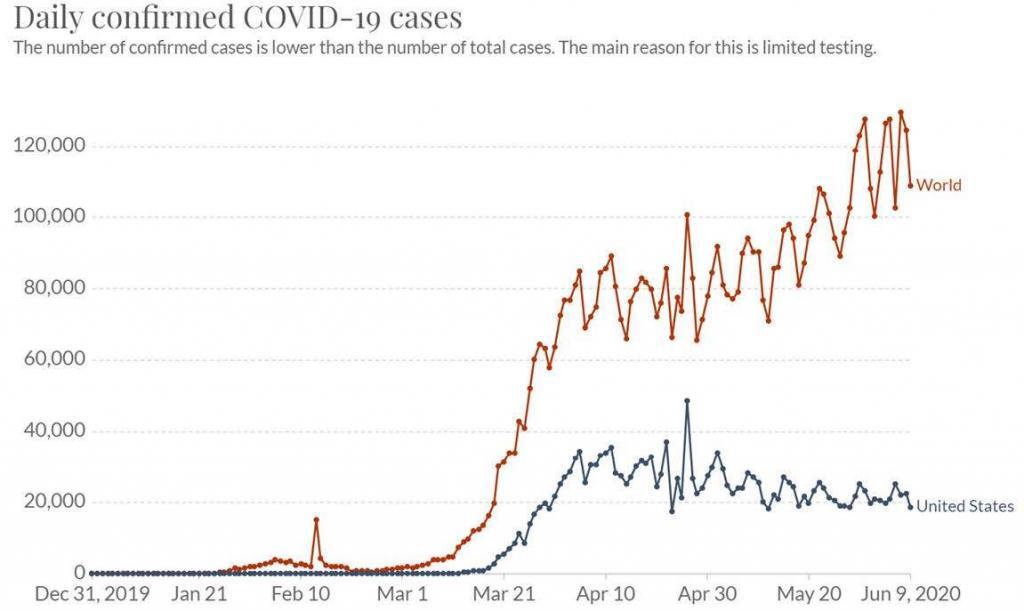

As COVID-19 continues to move across the country, it has left the business world with a very different customer base than the pre-pandemic environment. Many consumers remain fearful, as new COVID cases spread at home and abroad that are likely to continue to raise concerns. As illustrated in the following chart, cases are escalating worldwide, as new cases are recorded in emerging markets.

Source: Our World in Data

The pandemic began in Asia, shifted towards Europe, then made its way to the United States. Now there are case increases in places like Brazil and India. While it appears that the U.S. has successfully surpassed the peak of new cases, the curve has substantially flattened, but not bent downward as quickly as many had hoped to see.

The U.S. is plateauing at around 20,000 new cases every day. This indicates that the spread of the virus remains, and social distancing recommendations will likely stay in place. That’s going to continue to impact consumer habits significantly through the summer months and the second half of the year, resulting in ongoing economic ramifications. Prevedere will continue to watch this unfold, but it is far from over. The key takeaway is that consumer habits are immensely impacted and will continue to be for some time to come.

As we look towards the second half of the year, and even into early 2021, the likely economic scenario will be a U-Shaped recovery. In reviewing consumer intent data, many appear to believe they are in this for the long run. There isn’t likely a fast-track return to pre-pandemic normal, and consumers are developing new shopping habits every day to reflect this. Consumer sentiment data foreshadows a conservative recovery in 2H 2020. With a likely return to somewhat normal towards the latter half of 2021.

However, there remains recovery-risk depending on how the coronavirus trends. If additional outbreaks continue or grow, increases in control measures may be enacted to get the virus under control.

What does it mean for consumer spending?

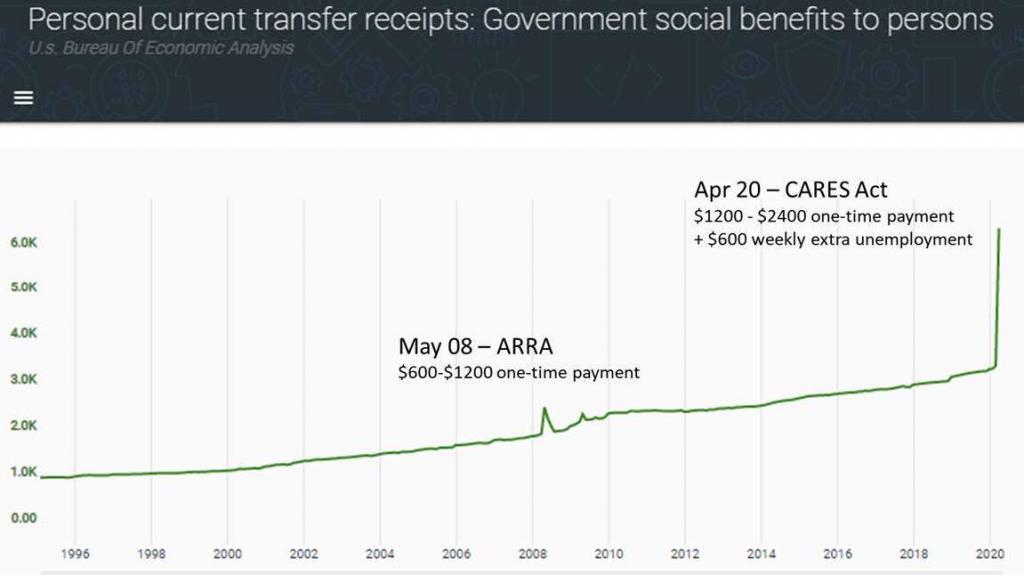

There has been an unprecedented level of government stimulus allocated to COVID-19 relief efforts. The CARES Act was generous, to say the least when compared to historical standards. The last time a significant U .S. federal government stimulus program was triggered was 2008 in response to the last recession and included one-time payments of $600 or $1200. Less than ten years later, the government doubled that through the CARES Act to $1200 and $2400 one-time payments.

In addition to the healthy stimulus, with nearly a quarter of Americans qualifying for temporary or a permanent job displacement, the government has implemented a $600 weekly added unemployment benefit. There is a large amount of government action in place to shelter the blow of the shelter in place policies that have been enacted.

Interestingly enough, these stimulus efforts have helped delay some of the effects of the pandemic. Many consumers, even if they’ve had a drastic life change such as losing their job, might not be necessarily feeling the effects of it right now because of the very generous stimulus at this time. We need to remember that the U.S. was in a healthy economic environment, Americans were told not to go to work, rather than economic hardships as the cause.

Around 40% of those collecting unemployment are receiving funds, on average, more abundant than what they were earning before when they were employed. We could still see more disruption this summer as some of these stimulus measures start to expire, but not all jobs that were lost suddenly reappear. Many unemployed Americans could be anticipating that they are getting their jobs back but find that their job no longer exists.

They could also find that their job still exists, but in a muted capacity whereas they are called back for part-time versus full-time work. It will be interesting to see how much Americans continue to conserve their spending through the summer months and how that affects employment in the restaurant and larger travel & hospitality space.

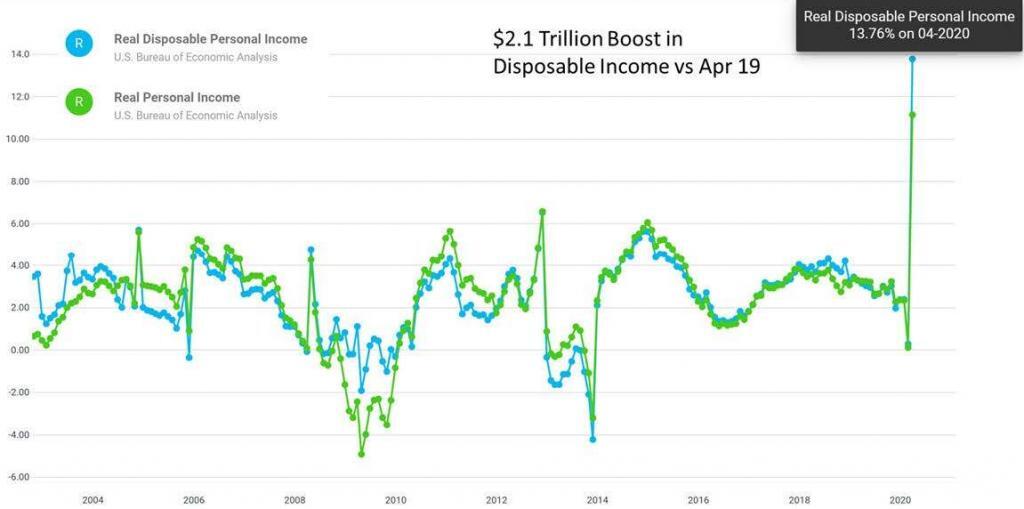

Regardless, there has been a record year-over-year boost in incomes to the tune of around 14% on yearly basis. That is a $2.1 trillion boost. This will decrease because of the temporary nature of the stimulus. That was the trend in March—incomes were starting to decline as they traditionally would ahead of a recession. The U.S. stepped in with some aggressive stimulus to counter the threat by giving consumers the ability to spend.

Understanding Data, Hard Data, and Soft Data

The real challenge to the economy becomes whether consumers are going to spend. This is where the hard data, such as income and employment become overrun in the near-term by the soft data, such as if consumers feel comfortable spending. The psychological effects of this are very extreme and will dictate consumer spending in the next few months.

It’s essential to look at the hard data and pair it with softer data, such as sentiment and intent metrics to better gauge demand. When you look at traditional metrics such as unemployment rates, there’s really a mixed message for several reasons. And no case is better than the Bureau of Labor Statistics employment rate data.

It was a big surprise when the May jobs report indicated that 2.5 million jobs were created in May. This caught many off guard because the survey of economists right before this data released had predicted a potential eight million jobs lost in May. So, people were shocked on the positive outlook, but this comes with several caveats.

For one, there is a wide range of error right now in much of statistics due to COVID-19. The same challenge everyone is facing is happening at the Bureau of Labor Statistics, where they are having a harder time with outreach to obtain good survey numbers. There’s been a dip in the response rate to the household survey that informs the unemployment rate from 82 to 67%, which widens the margin of error.

There are also misclassification errors in the last few months cited by the Bureau of Labor Statistics. The unemployment rate might have declined to 13.6%, which is still very high, but there could be a possible 3% increase in that number due to misclassification errors bringing the real unemployment rate to 16.6%.

In dealing with the COVID-19 recession, businesses should not narrowly focus on just a few indicators. The unemployment data from last month could provide a false hope for a very quick recovery. But in a broader context, there are still many challenges.

Economic Outlook: Summer 2020 and Beyond

Consumer intent is going to be critical. How consumers are feeling regarding their health and safety is going to drive spending. Many have experienced an increase in income due to the stimulus, but how they spend that money will better illustrate what recovery will look like. Are they recirculating it into the economy, or are they saving because they are cautious in many ways?

And so how consumers feel about spending in specific categories is going to be much more important than their ability to spend in specific categories, at least over the next few months. There is cautious optimism on the reopening of the U.S. economy, while the number, even though the number of cases is still very high. Any move towards normalcy is positive in healing the economy and the damage caused.

There are still real hurdles ahead, as the U.S. transitions away from a stimulus-driven economy towards the traditional supply and demand in the labor market, including the fact that the PPP loans designed to cover payrolls for eight weeks are expiring. So the question becomes, are businesses going to keep people on the payroll as that expires.

On the employee side, the expanded unemployment benefits expire July 31st. What is the labor market going to look like in August as well as people’s incomes?

There’s still a wide range of outcomes, but we do expect a continued recovery in the second half of the year. It will be a slow, U-shaped recovery more than a V-shaped, due to the massive disruptions to the labor market in the United States and around the world.

Nielsen Perspective

It is certainly no secret that the world has dramatically shifted, just over the past four months. A lot of the challenges in the global economies are driving significant changes in consumer behavior. Understanding those changes and ultimately planning for them are critical to our future success.

Economically, one in four Americans has filed for unemployment during the pandemic. But there are some questions about the accuracy of those numbers and how high that number could potentially go. So it’s interesting to try to understand just how many Americans did experience unemployment during this pandemic. At the same time, it’s really in stark contrast with food and beverage and CPG sales. There has been $50 billion in incremental growth that’s occurred year-over-year in the CPG space.

70% of that growth was from truly increased consumption. We know there was considerable stockpiling that happened during the pandemic. But 70% of that $50 billion was consumed by consumers in a magnified fashion year-over-year. On the surface, the CPG industry as a whole looks relatively rosy when you think about the boom that’s happened as a result of COVID.

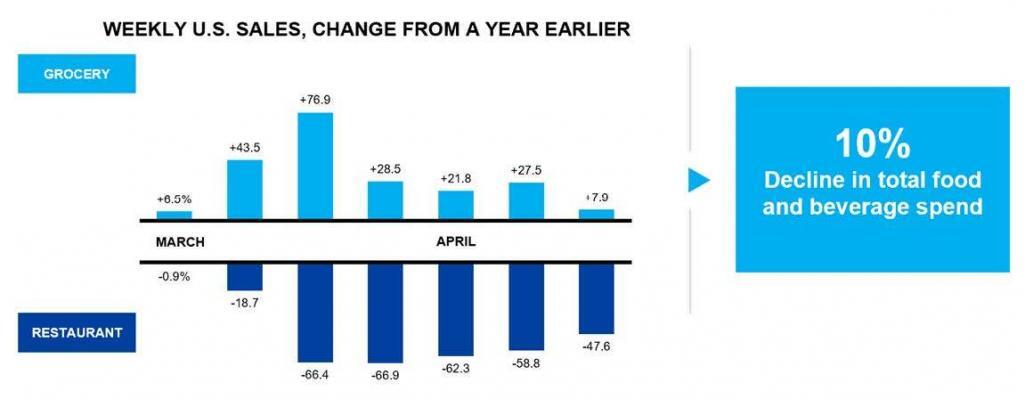

But in digging deeper, there is a different sort of story start to emerge. While grocery volume is thriving, a lot of the growth in grocery comes at the restaurant industry’s expense. During the peak of the pandemic lockdowns, when things were starting to shut down in mid-to-late March, grocery volume surged at close to 77% growth year over year. But restaurant volume over that week and then the five weeks that followed suffered a minimum of really 50% loss for those five consecutive weeks.

Source: Wall Street Journal; Nielsen xAOC (grocery in-store sales), Black Box Intelligence (restaurant same-store sales); Week Starts with the first full week in March.

Considering that picture in total, what you see is that household food and beverage expenditures were down 10% year-over-year. So, while there was significant growth in the CPG food and beverage space, it was not enough to make up for the declines in food and beverage that were happening on the restaurant side.

All in all, consumers were spending about 10% less, and that gives a little bit of new context to the $50 billion growth number for the CPG industry. When moving outside of just food and beverage, or just CPG, even more, divergent trends emerge.

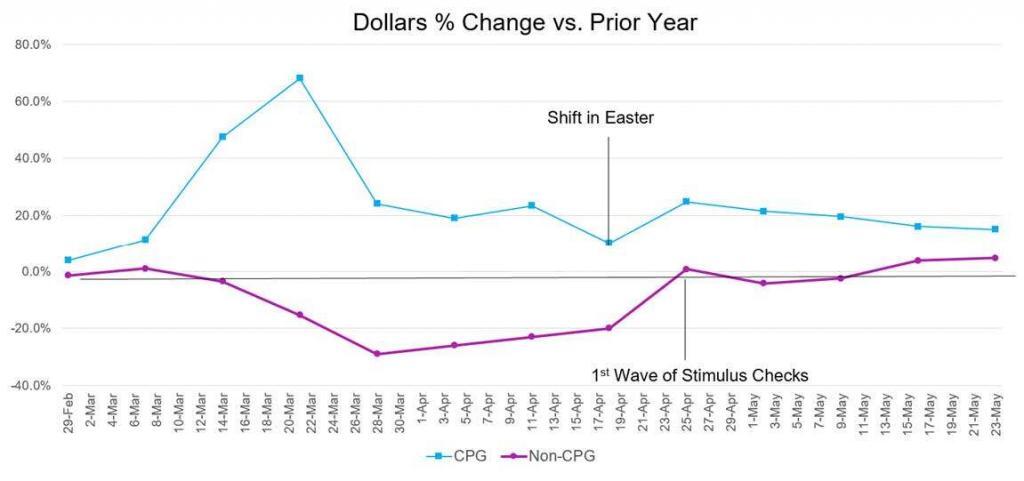

Looking at traditional CPG, food, beverage, home, and personal care, compared to non-CPG, or things like apparel and home goods, luxury items, there is a different story.

There are dramatic, year-over-year declines in the non-CPG space at the height of the pandemic. Consumers shifted their spending into CPG, which is represented by the blue line in the following chart, and decreased their spending in a year-over-year comparison in non-CPG. The first time non-CPG volumes start to tick back towards normal or at least match trends to over a year ago, was when the first wave of the stimulus checks was released.

Source: Nielsen xAOC + Ecommerce; The NPD Group/Point-of-Sale Early Indicator Report, NPD Universe

Of those households that are unemployed, 40% of them are making more money than when they were employed. They are spending more on CPG and less in restaurants. They are spending the same or less in non-CPG categories, as they were a year ago.

Consumer spending has dropped for these CPG and non-CPG categories that we’re measuring, due to consumer sentiment. The soft data here supports that consumer sentiment is generally misaligned with how they’re spending their dollars.

In recent Nielsen consumer research, 54% of consumers said that they were “ready to go” as it related to getting back to a new normal. This is a 20-point increase over just four weeks ago. Even more telling are the consumers who said they were going to wait and see what a new normal might look like before they could say whether they were ready to embrace it.

That number decreased by 18 points. That is 11% of consumers indicating that they are going to wait and see. But it’s important to understand what a new normal will look like, and this new standard will look quite different for many.

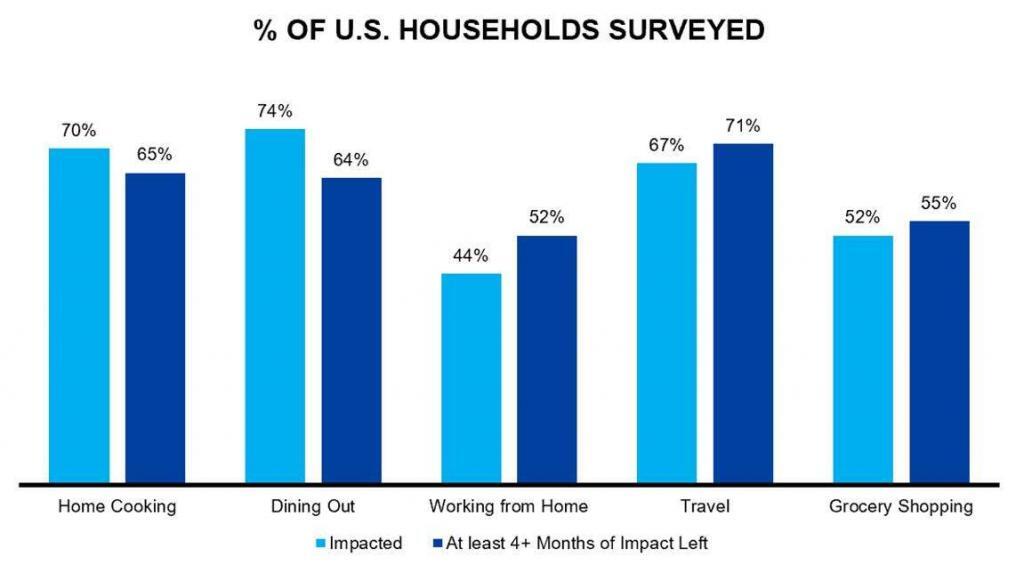

The majority of consumers surveyed indicated that their behaviors have changed dramatically by the pandemic, but they also expect their impacted behavior for a minimum of four months into the future. This indicates that whatever this new normal is will be dramatically different from conditions p re-COVID19. This manifests in a couple of ways, significantly is the idea of health-minded buying.

Source: Nielsen Global Survey, “Understanding the Impact of COVID-19 On Consumer Behavior”, April 2020

Consumer intent is going to be critical. How consumers are feeling regarding their health and safety is going to drive spending. Many have experienced an increase in income due to the stimulus, but how they spend that money will better illustrate what recovery will look like. Are they recirculating it into the economy, or are they saving because they are cautious in many ways?

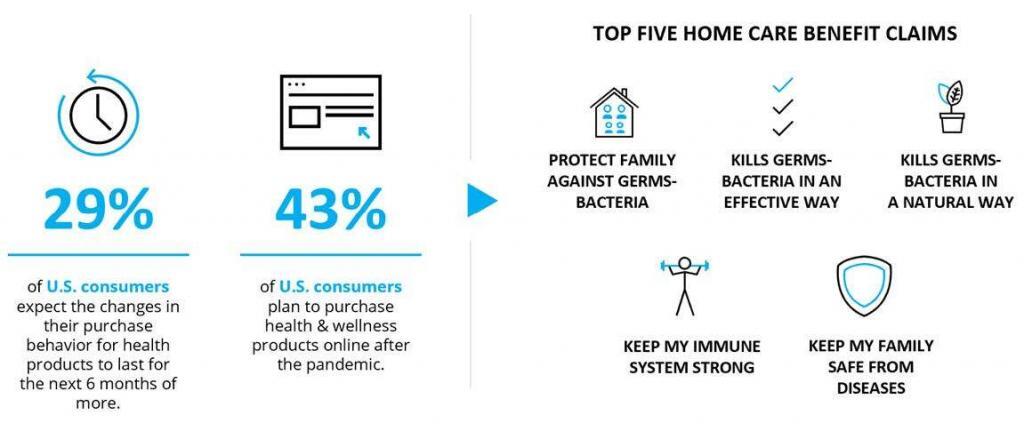

What and where consumers purchase will shift over time as we move into this new normal. 29% of consumers tell us that they’re going to change to be more focused on health-minded buying for at least the next six months. And 43% of consumers are telling us that they are going to make those purchases online.

Source: Nielsen Global Survey “Understanding the Impact of COVID-19 on Consumer Behavior” conducted in March 2020; Nielsen BASES COVID-19, consumers’ sentiment; Quick Screen claim analysis across 15 countries

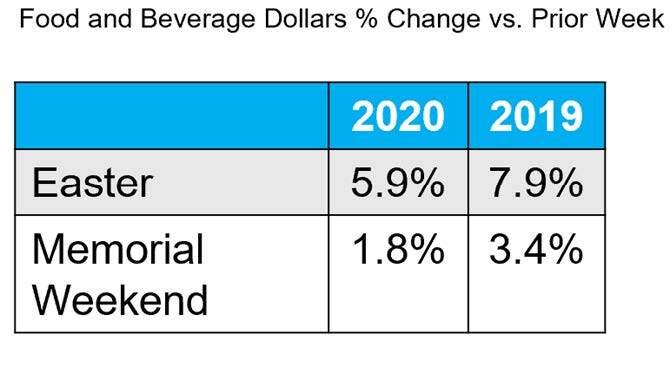

When considering what is driving purchase decisions, recent purchase decisions show increased concern for protecting against bacteria and keeping their families safe. All of these changes will impact summer holidays, and early data shows softened growth versus a year ago, for the kickoff summer holidays of Easter and Memorial Day weekend.

We saw growth in 2020 as compared to 2019, but it was a growth rate that didn’t match YOY growth. Growth had been consistent throughout history as volume pops, and as consumers start to kick off the summer, they dive into summer barbecues, family and friend events.

Source: Nielsen xAOC

This year will likely not experience growth in the same way as in past years based on this early data. We will see what, where, and how consumers engage with CPG brands will really shift. How consumers shop in general will change across the categories they buy, the brands they buy, and the channels in which they shop.

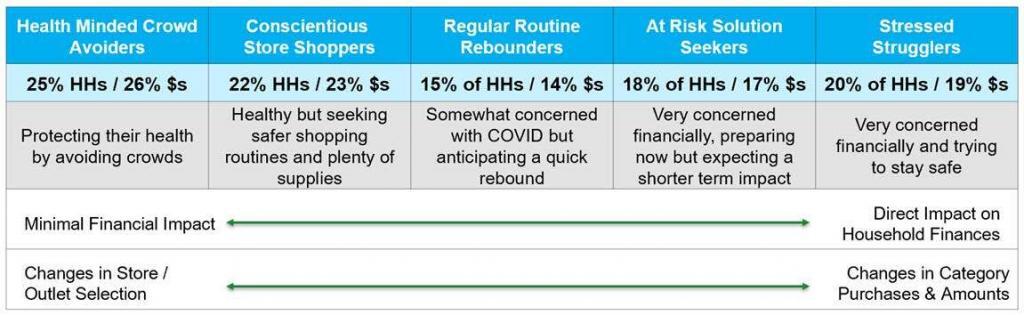

These behavioral changes link back to changes in the environment and perception. In the following chart, from left to right, there are varying levels of impact on households across the U.S. On the left-hand side, when you think about health-minded crowd avoiders, you see households that were least impacted by changes in the economy as a result of the pandemic.

And when you move to the right to our stressed strugglers, what you see are the most impacted households. These households and these impacts that they’ve experienced, correlate closely to purchase behavior. Stress strugglers are experiencing a much more limited ability to stock up on critical needs for their household.

They are very concerned about the financial impact the pandemic has had, and they are struggling to feel confident that they can keep their households safe. They’ve experienced a direct effect on their household finances, and that’s changing how much and what they can purchase. The health-minded crowd avoiders and the conscientious store shoppers are households that are much less impacted.

They certainly understand the impact that COVID has had on their household decisions. They are avoiding crowds, they are generally seeking safer shopping options, but they’re much more likely to return to their routines quicker, into whatever their new normal is than the households that fall on the right-hand side of this chart will.

As the U.S. progresses, there are two key things to watch. The first is how these households behave over time. This will be a key indicator of recovery expectations in the CPG and non-CPG space. The second is how these impacted households might shift along the spectrum over time. Federal unemployment will end on July 31st, and affected families will be returning to state only unemployment. There could be a second wave that hits this fall or winter. Events such as these could initiate change in consumer behavior.

Lessons Learned from Behavior Changes to Prepare for the Rest of the Year

There have been many lessons learned over the last several months that can help guide companies in operating in this new normal. Nielsen has identified five key strategies to address how these changes will impact the rest of the year and prepare for the effect that that may have on business performance.

The first is to evolve with the consumer. Consumer behavior is evolving quickly, and no one is sure what that new normal will look like. Ensuring a fluid strategy that allows plans to move with the consumer will help drive success. Planning for the holidays accordingly will be key. The early indicators tell us that the summer holidays aren’t going to look like the holidays of past summers. Being aware and looking ahead to that will help you succeed with the plans that you have in place.

The second is to understand your pricing and promotional strategy. The price consumers are paying at the shelf continues to rise as a result of limited stock on shelves, reduced number of brands, and retailers trying to recoup some of the expenses that they’ve had to cover in terms of additional employees or additional safety precautions for employees and for consumers.

Along those same lines, it’s really important to optimize production, distribution, and assortment. Those go hand in hand to make sure that the consumer supply can match the demand in the marketplace.

And then finally, be sure that you’re diversifying your channel strategy. Companies that place all of their balls in one basket will be the most susceptible to harm as we move through these changes in this environment.

Understanding how you can meet consumers where they need you to be with your products or with your service will be critical to success.