The following blog is part one of a two-part blog series, The US Quarterly Outlook in the Midst of the Coronavirus, based on the US Quarterly Outlook report webinar by Prevedere economists. The goal of this two-part series is to help executives make informed planning decisions in the wake of a complex economic landscape, based on quality economic data using the expertise of Chief Economist, Andrew Duguay.

I think we all understand the timeliness of this quarter’s US economic update. As we’re facing many new and escalating challenges on the global economic front, particularly from the Covid-19 coronavirus, it is essential first to recognize the impact that this health crisis is having on lives around the world. We want to ensure that as a company, we acknowledge the effects that the coronavirus has on human beings, as well as the immense complexity in combating and stabilizing the spread of the virus.

The US Quarterly Outlook in the Midst of the Coronavirus

The coronavirus leaves the global economist community with higher risk and uncertainty to future economic conditions than in previous estimations of future financial performance. And so while we talk about forecasts and projections, nobody can truly predict where this virus is headed; instead, it is our responsibility to present real economic context and impact scenarios.

The US Quarterly Outlook report is a compilation of leading economic indicators that we are continually monitoring in real-time. These are the same indicators executives and finance professionals should continue to monitor both for potential impacts related to the virus as well as leading indicators for recovery events.

Last quarter, Economist Thomas Kilbane provided the outlook for the 2020 economy. Mr. Kilbane discussed potential vulnerabilities and strengths that the US economy faces. The US economy has been continuing to expand since 2010, creating a healthy long economic period. However, most of the leading indicators presented suggested that slower growth was approaching for many sectors in the US economy with pockets of weakness, particularly in manufacturing and trade.

As we think about the virus in supply chain disruptions, it becomes imperative that we consider pre-existing weakness. Where there are vulnerable and weak market sectors, they may likely tip into a contraction depending on the trajectory and duration of the unwelcome coronavirus.

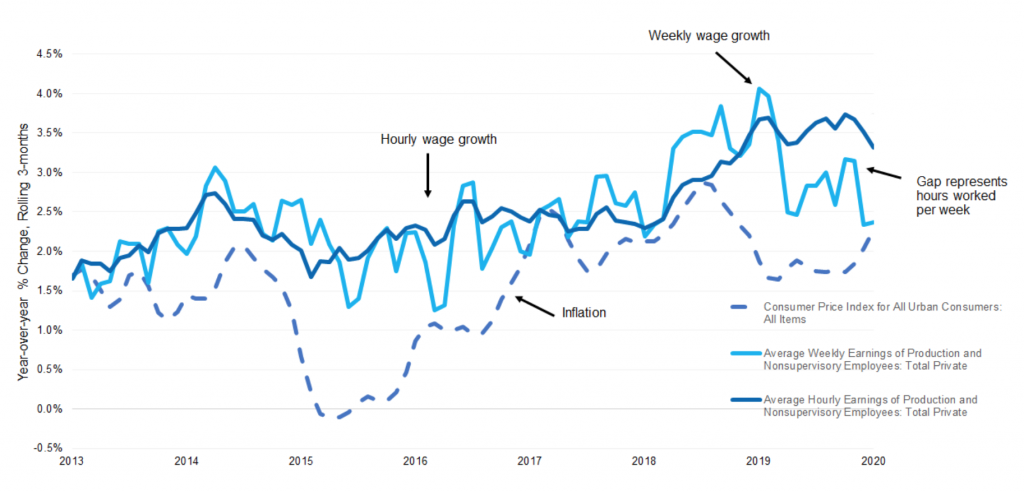

Shifting our focus for a moment to the most favorable factors that are coming out of the US economy, domestic consumption is on our mind. The positive trend in recent GDP growth is mostly stoked by US consumer spending, which was buoyed by lower interest rates as well as favorable weather conditions through the winter season to boost shopping as well as new home construction.

GDP Trends, The US Quarterly Outlook

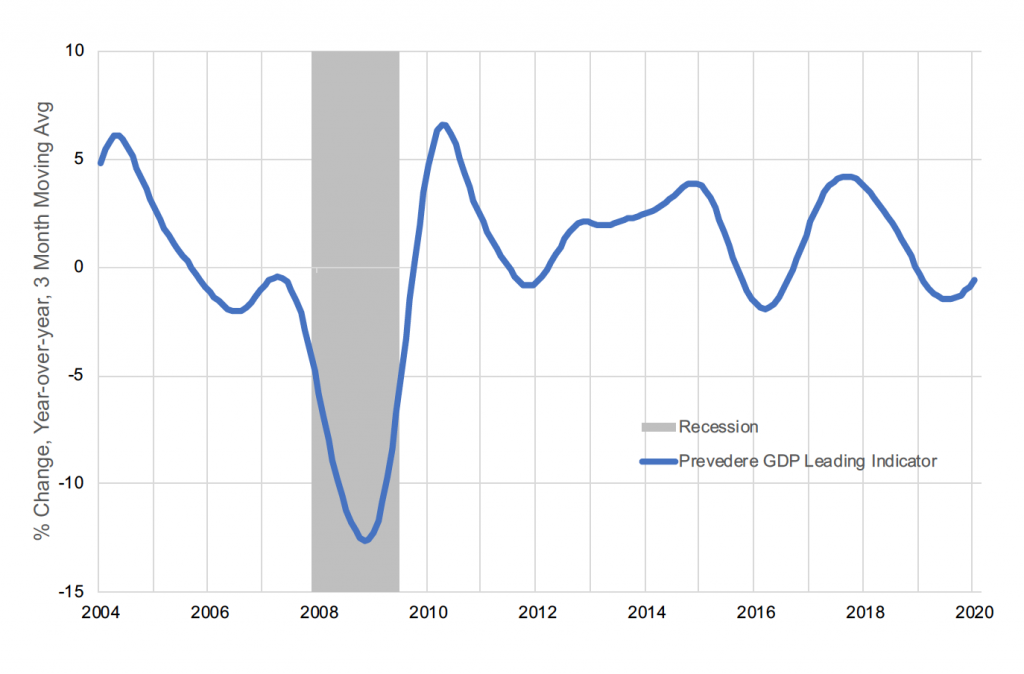

One of the key indicators of gross domestic product (GDP) that we like to follow at Prevedere is our very own Prevedere GDP Leading Indicator. The blue line on the chart below is our custom design composite that signals GDP changes ahead from two to three quarters out into the future.

The proprietary composite indicator was sending off warning signals last year because it was consistently falling. The falling indicator was despite meager unemployment rates and strong GDP growth. The GDP Leading Indicator suggested that the overall GDP growth at least slow down as we headed into 2020.

As we examine the latest data points, we need to keep in mind that this does not primarily include the impact of coronavirus. The data is accounting for key longer-term leading indicators that analyze over the past ten, 20 even 50 years for signals of key business turning points. Anomalies and externalities can impact GDP, and coronavirus is undoubtedly a factor. However, looking at the economic context, there is already signaling that the US economy was going to experience mild growth slow down.

As we look deeper at the turning point in the slide above, it becomes apparent that all else equal before the coronavirus event happened, there were positive leading signals that were suggesting we are not heading for any degree of recession this cycle. However, instead, we could be on the brink of a new recovery cycle.

The recovery would appear to be much like the recovery we experienced in 2016 or even in 2012. During both stretches, the economy experienced modest vulnerability, slower growth, and even some industries that went into contraction. However, the US economy as a whole in consumer spending did not contract. In summary, this outlines the economic headwinds and tailwinds that we are most strongly considering right now as we head into 2020.

We’re not without some economic vulnerability in the US, but we do not see strong signals of an outright recession. However, this comes with some concerns and the caveat of different potential scenarios for coronavirus that may introduce a more significant risk of recession, and we will be talking about that in our following blog. Let’s keep in mind the broader context is that we do see some positive signals coming out of our GDP Leading Indicator. This could allow the US to see a swifter recovery after virus-related slowdowns.

New data is coming out daily, and there are many scenarios to play out in 2020, from whether the coronavirus presents an economic blip on the road to recovery, or stalls any positive momentum and escalates a downturn. The second part of our Economic Outlook blog series will examine several financial models in terms of the potential impact of the coronavirus.

Watch the full US Quarterly Outlook with a Special Coronavirus Report webinar by Prevedere economists

***

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Prevedere is a predictive analytics software company that delivers insights into future business outcomes based on current economic trends. Our predictive economic intelligence helps executives see what lies ahead for their business and solve for upcoming risks and opportunities. Our SaaS solutions apply the power of machine learning and predictive modeling to more than 2.5 million indicators of global economic and consumer activity. Prevedere customers include Fortune 500 industry leaders in retail, manufacturing, and consumer packaged goods. To learn more, visit www.prevedere.comand follow @Prevedere on Twitter.