Last Updated: June 22, 2018

As retailers flock to New York City this week for NRF’s Big Show (say hi to our own Todd Carlton while you’re there!), there’s sure to be plenty of conversation re-hashing last year’s performance and projections for what will stick with consumers this year. But even the coolest devices, most creative marketing strategies and smartest teams are heavily reliant on external driving forces. With that in mind, let’s take a look at what Prevedere’s retail leading indicators project for the industry in Q1 2017.

First, how do we create these indicators?

Using the latest in cloud computing, Prevedere continually analyzes millions of global data sets to determine the best leading indicators for the retail industry. Our patented predictive analytics engine then determines the “domino effect” that these factors have on each industry. We then thoroughly back-test our models, ensuring its output closely aligns with at least 5 years of historical data. If our models accurately “simulate” the past, then we have confidence in their ability to predict the future. For example, we used this process to accurately project 2016’s strong holiday season, despite some traditionally cited indicators to the contrary.

Below is our outlook for 4 key retail sectors, as well as the leading indicators that help us determine these forecasts.

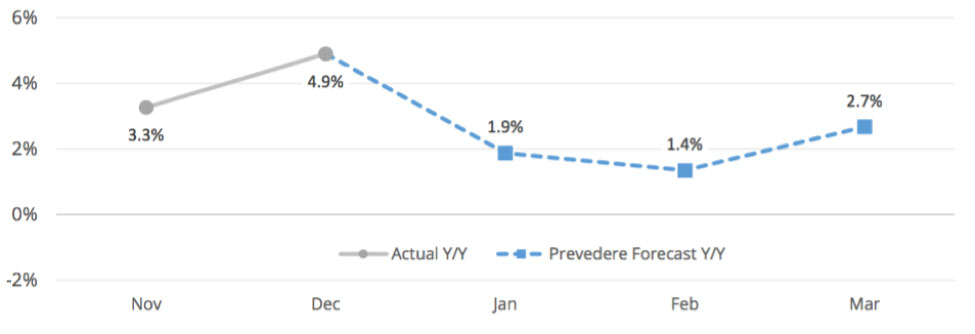

Grocery

A bright spot for retail in Q1, sales volume at grocery stores is expected to steadily exceed that of 2016 – spiking in March with 2.7% growth.

Indicators to watch:

- Consumer Sentiment

- PMI Composite Index

- Durable Goods Shipments

- Retail and Food Service Sales

Download Prevedere’s full Industry Performance Forecast for the grocery sector >>

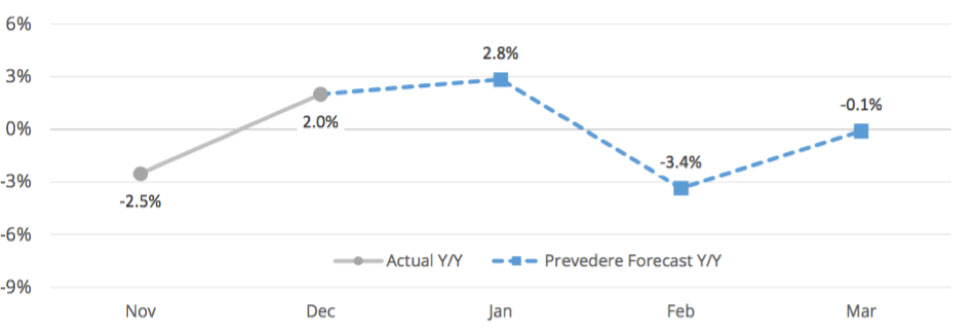

Electronics and Appliances

A strong January, with sales volumes 2.8% higher than last year, will be followed by a slowdown in February and March.

Indicators to watch:

- Hourly Earnings: Electronics

- Cass Freight Shipments

- Memory Chip Sector

- Domestic Auto Production

Download Prevedere’s full Industry Performance Forecast for the electronics/appliance sector>>

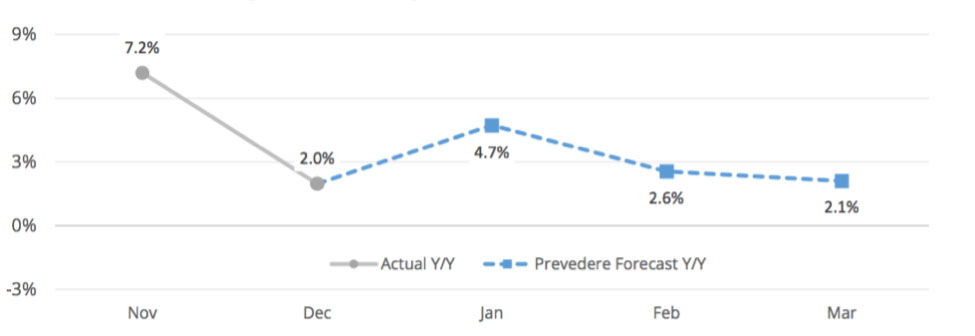

Furniture and Home Furnishings

The most promising retail sector in Q1, furniture and home furnishings is projected to grow at least 2% from last year’s rates.

Indicators to watch:

- Consumer Sentiment

- Personal Savings Rate

- Hourly Earnings: Merchandise

- Weekly Earnings: Merchandise

Download Prevedere’s full Industry Performance Forecast for the furnishings sector>>

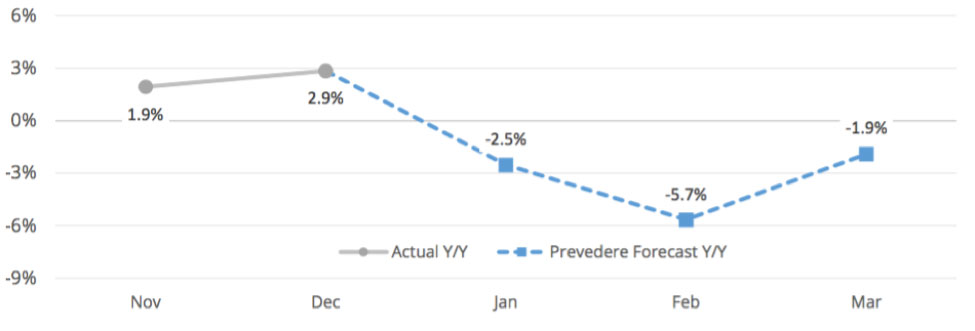

Clothing and Accessories

Major deceleration is anticipated in clothing and accessories, hitting a low of -5.7% year-over-year growth in February.

Indicators to watch:

- Architectural Billings Index

- Average Weekly Hours: Retail

- Consumer Sentiment

- Personal Savings Rate

Download Prevedere’s full Industry Performance Forecast for the clothing/accessories sector>>