Financial Planning & Analysis

Demand better financial forecasting accuracy by rapidly analyzing global economic data.

Are you making financial forecasts in the dark or with the facts?

Creating reports of internal metrics is easy. But what about the hundreds of external factors that impact your business. But it’s impossible to forecast the entire global economy in real-time, right? With Prevedere, you can.

We collect millions of global data-sets, update them daily, and ensure they’re “model-ready”. We can help you quickly find the hidden leading drivers of your company’s revenue or profit. We will assist you in reduce forecasting errors by 50% or more and reduce reporting and planning process time by 70%.

Key Financial Insights

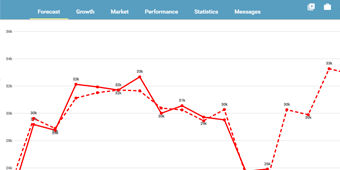

Create data driven forecasts in minutes

Correlation Engine

Prevedere’s Correlation Engine determines the best leading indicators to use by rapidly analyzes millions of external data sets with any of your internal metrics. Using powerful machine learning and cloud computing, you can determine the lead time and predictive confidence and create models in minutes rather than days.

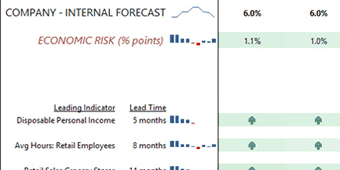

Economic Risk Report

For accurate financial forecasting, having a clear understanding of internal and external threats to your business is critical. With Economic Risk Reports, you can easily understand when the economic factors will put upward or downward pressure on revenue, profit, or market share compared to your target objectives.

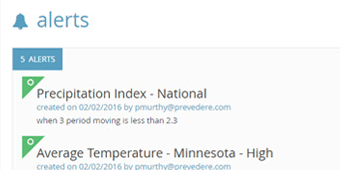

Global Data Alerts

With an ever-changing global economy, you can setup Economic Alerts that send you an email when any external data set or forecast drastically changes. By staying on top of changes to any leading indicators, you can modify your plans to address economic uncertainty with sufficient time.

Hyperion/SAP Integrations

While Prevedere offers a web-based solution, we can easily integrate into your existing S&OP platform such as Hyperion or SAP BPC. We even have a plugin for Microsoft Excel and Office365 to download any data set or forecast model directly into your spreadsheets for further analysis.

How would this work in the real world?

On April 20, 2016, Argyle Executive Forum, in partnership with Prevedere, brought together leading CFOs and finance executives leaders in a discussion-based format to explore best practices in determining how external economic factors affect business performance, the true cost of inaccurate financial forecasting, and how to make fact-based decisions by leveraging existing big data investments.

Title: Leveraging Data to Make Sense of an Uncertain Economy

Panelists: Alan Rouse – Mars (Moderator), Javier Alarcon – ConAgra Foods, Cathy Hauslein – Mattress Firm, Chi Miller – Intel Corporation, Derek Smith – Prevedere

To hear the rest of this webinar, please click below.

Get Access!

What's Next?

Let us help improve your forecasts’ accuracy with our Financial Planning & Analysis solution.

“Prevedere’s predictive model was exponentially better than our track record of forecasting and re-forecasting. It builds confidence in the business.”